How do I become self-employed?

Would you like to set up an eyelash or beauty studio?

We'll show you how to do it here - the dream of self-employment. Have you attended a beauty training course and have decided that this is exactly what you want to do in the future? Then you should watch this video. We'll give you some basic tips on how to start a business and what to look out for. You can also watch our YouTube video on this topic.

We'll show you how to do it here - the dream of self-employment. Have you attended a beauty training course and have decided that this is exactly what you want to do in the future? Then you should watch this video. We'll give you some basic tips on how to start a business and what to look out for. You can also watch our YouTube video on this topic.

Part-time or full-time?

For most people, it is worth starting out as a sole proprietorship:

a) Small business owner according to §19 UstG - you do not have to declare VAT and you do not have to submit an advance VAT return. (Annual turnover in the previous year €22,000 and turnover in the current calendar year is not expected to exceed €50,000.)

If you make use of the small business regulation, you must include a note on your invoices, such as: "In accordance with §19 UStG, the amount shown on this invoice does not include VAT."

b) Standard taxation You are fully liable for VAT and entitled to deduct input tax. You must submit an advance VAT return on a regular basis, either monthly or quarterly.

Attention!!!: There are often fraudulent letters on the way that are very similar to an official letter. Make sure that the sender who is now demanding fees is a genuine authority.

Legal notice: This blog article does not constitute a legally binding statement. We are merely sharing our experiences with you.

We hope that this information is useful for you and gives you some pointers for your self-employment.

Your CFB Cosmetics® team

a) Small business owner according to §19 UstG - you do not have to declare VAT and you do not have to submit an advance VAT return. (Annual turnover in the previous year €22,000 and turnover in the current calendar year is not expected to exceed €50,000.)

- Advantage: Entrepreneurs who primarily work with private customers (price advantage as VAT

- Not applicable)

- Entrepreneurs who do not use a large amount of goods and have many expenses

- Entrepreneurs who set up part-time businesses

If you make use of the small business regulation, you must include a note on your invoices, such as: "In accordance with §19 UStG, the amount shown on this invoice does not include VAT."

b) Standard taxation You are fully liable for VAT and entitled to deduct input tax. You must submit an advance VAT return on a regular basis, either monthly or quarterly.

Business registration (costs between €15-60)

- Possible at the trade office or online in some federal states

- You will need your identity card

- The form should be completed conscientiously, including details of the business and range of services. The trade office will inform the tax office and HWK/IHK, and you will automatically receive mail from the authorities. In addition, the Federal Statistical Office and the Trade Supervisory Authority will be informed.

Tax office (tax registration)

You will usually receive this form automatically from the tax office within two weeks. If this is not the case after two weeks, it does not hurt to ask. Sometimes (very rarely) the communication channels between the offices are interrupted. The tax registration form currently comprises eight pages. We recommend the help of a tax consultant here. The VAT ID number can also be applied for using this form.IHK/HWK

The chambers are also notified automatically. In the event that you register an eyelash or nail salon, it will be the HWK. HWK membership is not voluntary. Every tradesperson is obliged to become a member and pay the fees. (However, exceptions are possible at short notice. Please check with the authorities. Payments should not be suspended without authorization).Attention!!!: There are often fraudulent letters on the way that are very similar to an official letter. Make sure that the sender who is now demanding fees is a genuine authority.

Tax consultant

You need the right tax advisor from hour zero. Choose one who is well versed in your field. There may be someone in your circle in the beauty industry who can recommend a tax advisor to you.Bank account

We recommend that you have your own bank account for your business. Keep your commercial income and expenses strictly separate from your private account, which will save you and your tax advisor a lot of work and hassle.Terms and conditions and right of withdrawal

You can either work with an online law firm that provides you with T&Cs and the right of withdrawal and updates them regularly, or you can create your own. Your T&Cs, right of withdrawal and price list should be visibly displayed in your studio and on your website. Please do not copy these from any website.Your website

Make your website legally compliant. We'll give you a few tips, but you should consider having a specialist lawyer look at and check the whole thing before you go online. Our tips for you:- Your legal notice must be complete. It should be possible to access the legal notice directly from the homepage.

- You should exclude liability for further links.

- You should have the necessary image rights for images that you use on your website. Note that you may have to name the author if you have purchased licenses for images. You can also include this in the legal notice, for example. You must clarify everything in advance in each individual case.

Social media

You should think about using various social media platforms so that you can market your company and become visible to interested parties: Facebook like page, Instagram account, Pinterest, YouTube, Vimeo etc. Make sure that your legal notice is visible on the first page of all these channels.A Google account

You should definitely set up a Google account for your company. Here you have the option of entering various parameters, such as opening hours, images of your company, contact details for your company, etc. Without Google you are not visible these days!Your logo/brand

It makes sense to create a logo as your distinguishing mark or trademark. This allows you to create a corporate design. Your business cards, flyers, website and even your studio should be based on this design.GEZ

If you want to listen to the radio or watch TV in your studio, you will have to pay GEZ fees.Insurance

Public liability insurance is required in any case. Depending on your needs, you may also need your own health insurance and/or pension insurance.Price list

Your price list should be fixed from the outset and visibly displayed in your business. Be sure to create a meaningful calculation as the basis for your prices.Declaration of consent from the customer

We recommend that you sign a written declaration of consent with every customer. This should include the following:- All details of the application

- Customer data anamnesis

- Reference to the GDPR (you should definitely study this topic in more detail)

- Permission to capture image material and, if applicable, the customer's permission to use this on social media platforms, for example

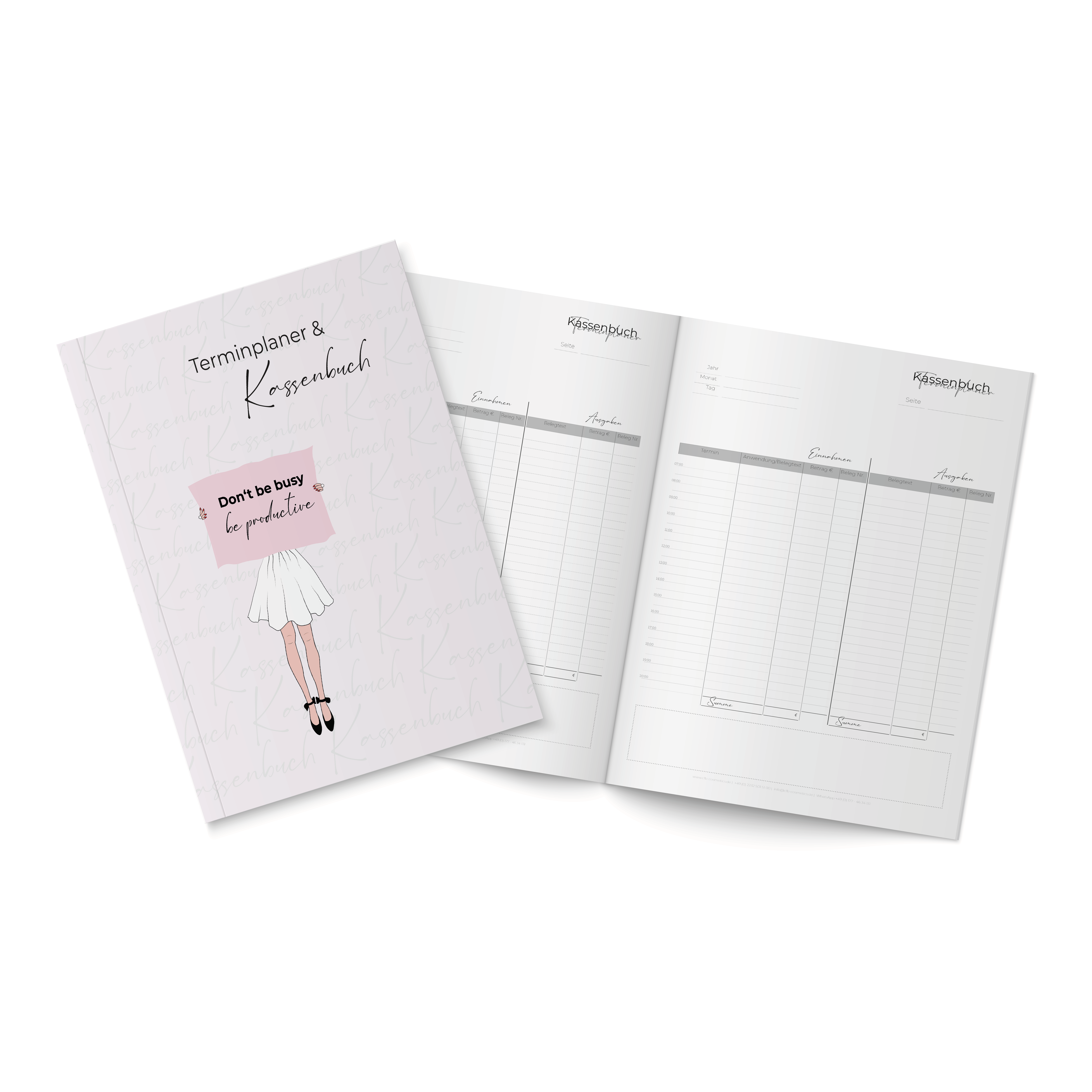

Cash book and accounting

Keep a cash book and record your income and expenditure on a daily basis. Give your customers who pay cash a receipt, either by issuing a receipt or a corresponding receipt.Legal notice: This blog article does not constitute a legally binding statement. We are merely sharing our experiences with you.

We hope that this information is useful for you and gives you some pointers for your self-employment.

Your CFB Cosmetics® team